131500 trains: Too Much of a Bad Thing?

As a regular Sydney rail commuter (on CityRail’s Southern Highlands line) I’ve been following 131500 trains on Twitter for some time. It’s a really useful service – giving Twitter followers advance notice of issues and delays on the Sydney rail network.

As a regular Sydney rail commuter (on CityRail’s Southern Highlands line) I’ve been following 131500 trains on Twitter for some time. It’s a really useful service – giving Twitter followers advance notice of issues and delays on the Sydney rail network.

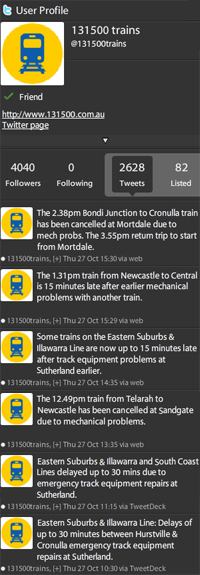

However, as you can see from a snapshot (left) of a timeline of @131500trains’ tweets, the bad news is unrelenting – “cancelled”, “late”, “mechanical problems”, track equipment problems”, “delayed” and “emergency … repairs” are all mentioned within the space of five hours and six tweets today.

I believe @131500trains is doing its brand considerable damage – and CityRail should rethink its approach to using social media as a notification service.

As a result of the constant barrage of bad news tweets, you get this type of response (note the use of the #cityrail hash tag!). A couple of today’s examples:

- So glad I’m working from home tomorrow…today. #cityFail (@twistedpicture)

- #cityfail Bad news folks. Delays on the network due to a breakdown on the line at Beecroft Have fun a this afternoon all! (@matPORTS)

A better approach would be to provide more targeted and specific information to those that need it. For example, I’m generally only interested in what’s going on the Southern Highlands and Airport & East Hills lines – so it would make more sense to have a separate Twitter account for each line for me to follow.

That approach would end up having two major benefits.

First, not as many followers would be exposed to CityRail’s bad news. If you look at the picture of @131500trains’ tweets on the left, not one relates to either of the two lines that I regularly use. Also, it might open up the opportunity to throw in some positive news at the same time, specific to that line.

Second, CityRail would have more characters available to use for each tweet – because it no longer has to provide information about which line is affected in its 140 characters. As a consequence, there would be more room to explain the situation, which means better communication outcomes.

Then, using a few smarts and a bit of coding, I’m sure that CityRail can bring all these tweets from the different accounts together and present them via a less immediate and public channel (maybe its website) or possibly link them to the main timetable pages on its website for each of the lines.

Hypersensitive to Social Media Stats

It’s interesting how things have changed now that I’ve started up my own business. In my previous role as a corporate communications manager, I’d probably get on average 200-250 emails a day and dreaded having to clear my inbox of the day’s messages. Now, I get excited each time a new email comes in (btw, it’s maungle@explorecomms.com.au for anyone who wants to send me a message).

It’s interesting how things have changed now that I’ve started up my own business. In my previous role as a corporate communications manager, I’d probably get on average 200-250 emails a day and dreaded having to clear my inbox of the day’s messages. Now, I get excited each time a new email comes in (btw, it’s maungle@explorecomms.com.au for anyone who wants to send me a message).

It’s the same with website statistics. Previously, I’d pore over the monthly website stats, looking for trends and areas of user interest in terms of the traffic – average times spent on a page, paths through the site, referring pages and search terms, most downloaded case studies and documents. Now, I hang on every blog post hit on www.explorecomms.com.au; and I’m even more excited when I get a comment, or a link from another site.

Before I started up Explore Communications, I didn’t even know there was a tool called “Who’s Viewed Your Profile?” on LinkedIn – now I’m keen to see who has looked, and try to work out why they wanted to know more about me. I’m also keen to understand whether any of my actions – on LinkedIn, Twitter, on the web somewhere else or on this site – might have contributed to the stat.

So why the two peaks on the chart (pictured above)? The first was when I changed my main position on my LinkedIn profile, and the second was when the news was made public and an article appeared on the Australian media site Influencing.

The process for me has moved from the macro to the micro. Before, I was analysing the behaviour of the company and our market as a whole, and attempting to draw broad conclusions and insights from the stats. Now, I have the opportunity to analyse every single action or behaviour on both sides of the equation.

It makes a refreshing change.

The Future of Sports Broadcasting?

Last week, I saw a tweet from the Viocorp Twitter account …

Hockey fans we’re live streaming the Olympic qualifiers today and all week, Game starts at 5.30pm tonight at… http://t.co/cfOvfoiI

… and, with two of my boys very keen hockey players, we watched a little bit of the action.

As I was watching, I was struck by the fact that this is the future of sports broadcasting.

The live video wasn’t perfect – the speed of the game was a little too much for our Internet connection – and, at times, you had to piece together the action; but how often do you get to see a live broadcast of a hockey international outside of the Olympics?

Hockey is one of those sports that has a very strong base across Australia and very successful national teams, but without the commercial appeal of codes like cricket or AFL. As a result, the game struggles for broadcast airtime, even on pay television. When you consider the limited broadcast opportunities for sports like hockey, it makes perfect sense for the game’s administrators to reach directly to their audience via the Internet. After all, what’s the main purpose of an organisation like Hockey Australia?

However, I don’t think this style of broadcasting is limited to what some might call ‘fringe’ sports. You only need to look at Channel 9’s treatment of the pool games in the Rugby World Cup, currently being held in New Zealand. While Channel 9 purchased the broadcast rights to the World Cup, some pundits have argued that the network did so for purely defensive reasons – to protect its audience for the Australian NRL (rugby league) finals series. See the report on ABC’s Media Watch: http://www.abc.net.au/mediawatch/transcripts/s3336392.htm.

Australia’s peak body for rugby union (the ARU) may have received a good financial outcome by sharing in the proceeds from the sale of the broadcast rights for the World Cup, but it’s not ideal that the games being played are either not broadcast at all, not promoted by Channel 9, or are delayed in deference to the NRL games. Then, when Channel 9 did show a live game – such as the Wallabies vs All Blacks semifinal last night – why did the commentary make me feel like I was watching a horse race?

After all, for most sports, the mandate for their governing bodies is to encourage grassroots participation and increase the popularity of their code. And what better way to do that than by providing direct access to the Australian public to watch the game being played at its highest level – an international game.

Watching the men’s national hockey team (the Kookaburras) in action in the Oceania Cup against New Zealand might not have been perfect but, with the improvements in bandwidth that will come with the rollout of the NBN, watching a live broadcast of a sporting event – no matter how ‘fringe’ – will become commonplace.

By the way, the Kookaburras won the final against NZ 6-1. Let’s not talk about the rugby …

“go down and talk to the journos”

It was great to get a write-up on my new role and venture today (“Aungle explores new business, Jassal promoted influencing.com.au/p/40562“) in Influencing, a website for Australian & New Zealand public relations and marketing communications professionals.

I was chatting to Phil Sim from Influencing yesterday for the story, and I realised that I first met him nearly 15 years ago.

I had recently joined Com Tech Communications (as Dimension Data was known back then), in a dual marketing and online development role, after a couple of years as a legal editor at the publisher Butterworths. I was only a couple of weeks into the job, and we were holding a press conference about something at our head office – which at the time was in the very industrial Sydney suburb of Alexandria, close to the airport.

I remember being told by my boss at the time, “go down and talk to the journos.” It was a bit nerve-wracking, but I think I did OK. There were about 15-20 journos and analysts there, including Phil and I think a few others who are still in the industry today. I can’t remember what the press conference was about, although Phil thought it might have been a Netscape announcement, which would be about the right timing.

What was really great about some of those early press conferences and events were the connections that I made with media and analysts. With so much PR conducted online and over the phone, these opportunities for the ‘industry’ to get together and really connect are so few and far between these days, which is a shame.

The best opportunity for the industry to get together these days is Phil’s Kickstart Forum, and it’s great to see the model that MediaConnect has developed over the years proving to be such a success.

Amazon losing $10 on each Kindle Fire? No big deal.

A few weeks ago I blogged about HP exiting the tablet market, and the dramatic price cuts on the remaining TouchPad stocks. My view at the time was that:

A few weeks ago I blogged about HP exiting the tablet market, and the dramatic price cuts on the remaining TouchPad stocks. My view at the time was that:

“When it comes to tablets, it’s all about content – over time, the device itself will become a commodity, like the paper used to produce books, and have little intrinsic value in itself.”

Now, news is out that Amazon is losing US$10 on every Kindle Fire it sells – which is not such a big deal, when you consider that Amazon is all about making money from content.

For years, I’ve always thought that the courier companies are the big winners from online shopping – but that looks under threat now that more and more books, CDs and DVDs will be replaced with digital files purchased and downloaded directly to the device.

It will be interesting to see the retail prices on the next versions of the iPad …

Making Margin Calls on Pork Bellies

Below is a submission I wrote back in March 2008 for Heckler, a reader’s column in the Sydney Morning Herald, but for some reason I never sent it in. It was in response to the Global Financial Crisis, and what I saw as the ludicrousness of a financial system that had become so self-referential that people are making money from intangibles completely removed from the source of the original unit of productivity, and had created an ecosystem where a crisis in one part of the market could bring down everything else. We are still seeing this today – for example, the concerns over European sovereign debt blamed for the fluctuations in the Australian share market.

Below is a submission I wrote back in March 2008 for Heckler, a reader’s column in the Sydney Morning Herald, but for some reason I never sent it in. It was in response to the Global Financial Crisis, and what I saw as the ludicrousness of a financial system that had become so self-referential that people are making money from intangibles completely removed from the source of the original unit of productivity, and had created an ecosystem where a crisis in one part of the market could bring down everything else. We are still seeing this today – for example, the concerns over European sovereign debt blamed for the fluctuations in the Australian share market.

I don’t think our financial markets have learnt much from the GFC, and most of what I wrote in 2008 still holds true three years later. (I’ve added URLs to the original article I wrote.)

Making Margin Calls on Pork Bellies

Money markets and matters of finance have always been a mystery to me. However, the latest string of financial collapses has taught me a lot about modern economics.

When I heard the news that the US subprime mortgage crisis had caused a meltdown on the world’s financial markets, I wondered, “what is a subprime mortgage?”

Apparently, that is where companies lend money to people to whom they really shouldn’t. Most do this through what they quaintly call “low doc” or “no doc” loans – otherwise known as the “what I don’t know won’t hurt me” loan. When some of these subprime mortgage lenders went belly-up because too many of their borrowers (the people they shouldn’t have lent money to in the first place) reneged on their loans, it had a domino effect on various investment houses around the world who thought it was a good idea to sink funds into these businesses.

One of those was 140-year-old French bank Société Générale, where one of its futures traders lost an estimated €4.9 billion in trades involving European stock index futures. I was a bit more confident with this one – I’d seen the movie Trading Places, where Eddie Murphy discovers he has a gift for predicting pork belly futures, which is based on the future unit price of 20 tons of belly. This is a tradable commodity in the US because Americans like their bacon to be streaky. I guessed that European stock index futures were something similar.

Back in Australia, the subprime mortgage crisis affected one of our companies. Allco Finance Group’s share price has plummeted, with concerns raised about the level of related-party transactions undertaken by the company. What on earth are related-party transactions? I looked it up on the ASIC website, which defines them as transactions you enter into with someone who has a close, and possibly privileged, relationship with the company. It’s a bit like buying a car from your parents.

However, Allco’s big problem was margin loans, the same thing that hit ABC Learning Centres. This Australian childcare success story found itself in a hole when the share price fell and the founders were subject to a “margin call” from lenders. I’m still a bit in the dark on how this all works, but it seems that people borrow money to buy shares, but then have to pay it back if the shares fall below a certain level.

Armed with all this knowledge on how our global financial systems work, I’ve got a great concept for a new business. I am going to offer low doc, margin loans to related-party companies looking to invest in stock market futures. Now I just need to borrow some money to finance my new venture.

Any takers?

Telstra describing its old brand as ‘schizophrenic’

I watched a couple of videos today on Mumbrella, with Telstra’s marketing and creative people talking about why Telstra needed to rebrand. I can understand why it was time for it to happen, but what I don’t understand is why the messaging about the rebranding needs to be so negative.

In the first video, both Inese Kingsmill, Telstra’s corporate marketing director and Mark Collis, Telstra’s director of creativity and brand content refer to the old brand as ‘schizophrenic’ – which I find really odd when the Telstra brand has been so iconic since it was created when the company was renamed from Telecom Australia as part of its privatisation back in 1993.

I’m not arguing that the rebranding shouldn’t have happened – I believe that a brand should evolve with the times and its relevance to its stakeholders – but what I don’t understand is why people fall so easily into criticising what came before as a way of justifying the decision to change. If anything, the messaging should be one of celebration – the fact that Telstra has the opportunity to build on what has been such a powerful brand, particularly in the Australian market.

That way, you not only have the opportunity to talk about the success of the ‘old’ brand, but also to speak more directly as to why the rebrand was necessary as part of Telstra’s future. That relates to concepts including relevance to customers, engagement with employees, diversity of service offerings, alignment with corporate positioning, etc.

The danger in immediately criticising the previous brand as a way of ‘talking up’ the new one has the potential to undo a lot of the brand equity and value that a company has built up under the old branding, and therefore diminish the added value the new brand will bring.

Putting a Value on the NBN

I wrote a post this week for Global Access Partners’ Open Forum – Putting a Value on the NBN – because I am astounded with the difficulty everyone seems to be having in quantifying the benefits a standardised national broadband network will bring to Australian society.

I wrote a post this week for Global Access Partners’ Open Forum – Putting a Value on the NBN – because I am astounded with the difficulty everyone seems to be having in quantifying the benefits a standardised national broadband network will bring to Australian society.

It all started a year ago, when I heard the figure of $32 billion referenced at a Global Access Partners conference (picture left is a view from my seat in NSW Parliament House, where the event was held). $32 billion was the economic benefit calculated in 2008 that the NBN would bring by providing the data connections required to rollout highly-accurate GPS systems for use in areas such as agriculture, mining and engineering. Given the resources boom we are currently experiencing in Australia, and the increasing pressure to increase crop yields and food production efficiency in agriculture, that figure of $32 billion is probably now even higher than when it was calculated back in 2008.

We also have a carbon tax due to come into operation in 2012, and the documented environmental benefits from precision GPS-guided machinery will have a direct financial impact on organisations liable under the new legislation once it comes into operation.

Last night, at a Federal Government committee meeting on the NBN, CEO Mike Quigley got a grilling about NBN Co’s progress – but the real need at the moment is for government bodies, industry and community groups, with a vested interest in seeing the NBN rolled out, to quantify where possible the benefits the NBN will bring to their area of operation.

Nothing Like Australia

Last week I read about Tourism Australia’s new phase of its ‘Nothing Like Australia’ campaign – ‘Dream Team’. It’s a great concept for building user-generated content, and I think will be a successful campaign in what is a difficult time for the Australia tourism industry.

However, from a personal perspective, it’s a shame that it’s likely to be successful … because it has a couple of similar components to an idea that I’ve had bubbling away for some time now. I’ve had the website registered and parked for a couple of years (www.allaroundaustralia.com.au), and now that I’ve established my new business it’s time to build out the concept and start the process of developing the site.

In the meantime, I was happy to contribute to what I think is a great way to promote Australia as a travel destination. I submitted the photo above from a road trip we took last year to Broken Hill with the kids. This is taken on top of the huge mullock heap from the Line of Lode mine in the middle of Broken Hill. At the top, apart from the Miners’ Memorial and Visitors Centre, there’s an amazing collection of old mining machinery and equipment. We were up there near dusk, and the views and the colour of the sky were beautiful.